cryptocurrency tax calculator canada

Koinly can handle it all. Simply add up all your capital gains from the tax year and then halve the amount.

Crypto Com Now Offers Free Crypto Tax Calculator In Germany Financefeeds

If you owned it for more then a year youll pay the long-term rate which is lower.

. Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet. It takes less than a minute to sign up. Now easily Calculate your tax on every crypto transactions.

This means you may owe taxes if your coins have increased in value whether youre using them as an investment or like you would cash. You can estimate what your tax. Our free cryptocurrency tax interactive will help you estimate your taxes on your sales whether you received your cryptocurrency through purchase as a payment for services.

Guide for cryptocurrency users and tax professionals. You can then carry forward 1000 of losses for future tax years. If you held it for a year or less youll pay the short-term rate.

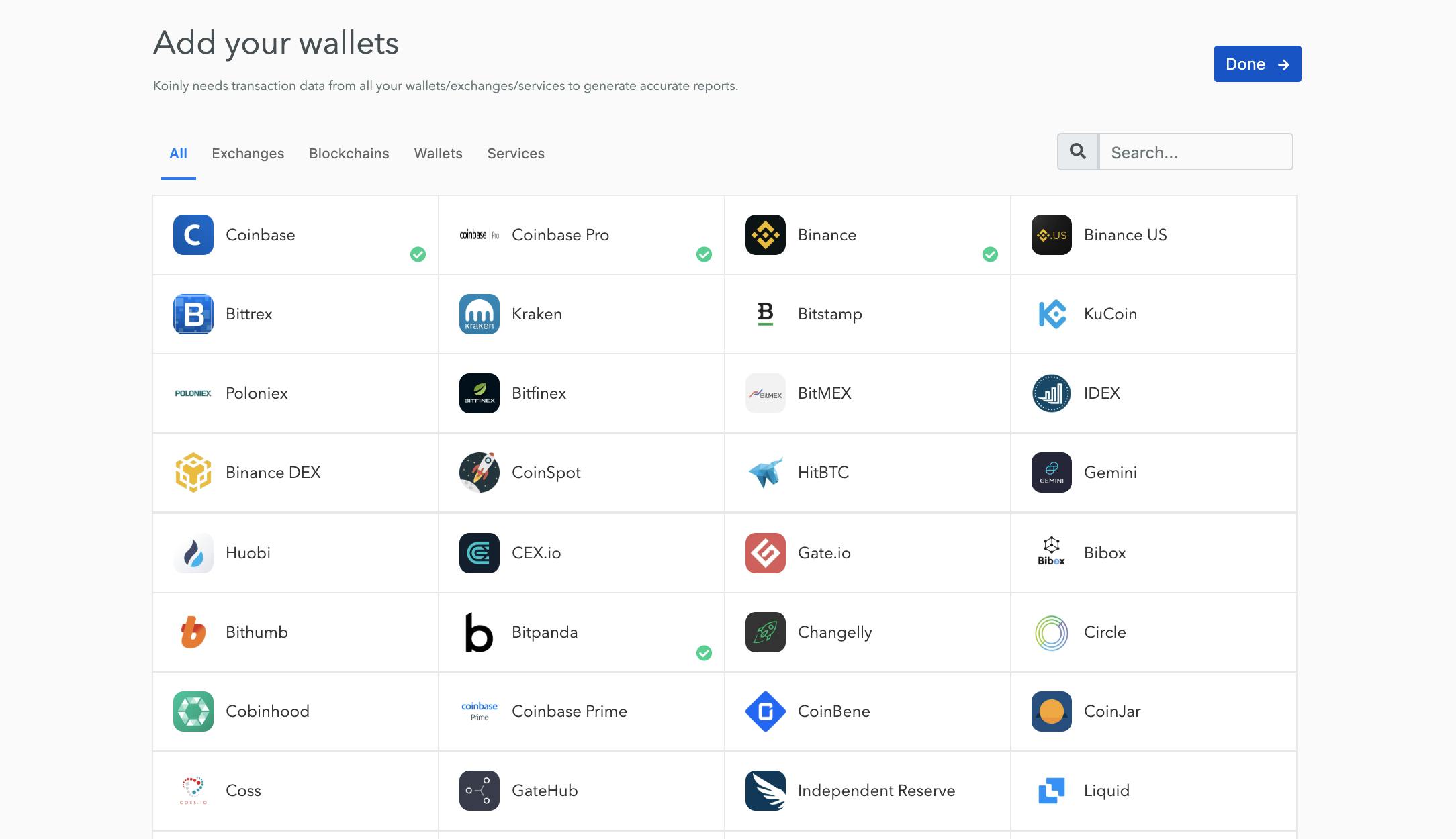

ZenLedger is another great option when it comes to cryptocurrency tax calculators. Our platform allows you to import transactions from more than 450 exchanges and. If you buy the cryptocurrency in a 30 day window either.

The product can directly. Use our crypto tax calculator below to. Coinpanda is the worlds most easy-to-use cryptocurrency portfolio tracker and tax software.

Whether you are staking on Kraken lending on Nexo or going long on BitMEX. The sum is how much you will need to pay tax. Select the appropriate tax year.

A Smart Data Sheet that will keep track of your all trading history and will automatically calculate profitloss along with the tax all. Koinly uses AI to detect transfers. The first CA14398 you make in income.

For income tax purposes cryptocurrency is considered a capital asset which means it is treated the same as any other gain on the sale of a capital asset Canada Revenue. Create your free account now. With no gains in the current tax year you use 4000 to offset your capital gains from 2021.

The Crypto Tax Calculator offers a 30-day money-back guarantee. Choose your tax filing status. Enter your taxable income minus any profit from crypto sales.

This tactic is known as tax loss harvesting and to circumvent this the CRA introduced the superficial tax loss rule. DeFi Margin trades Futures.

11 Best Crypto Tax Calculators To Check Out

![]()

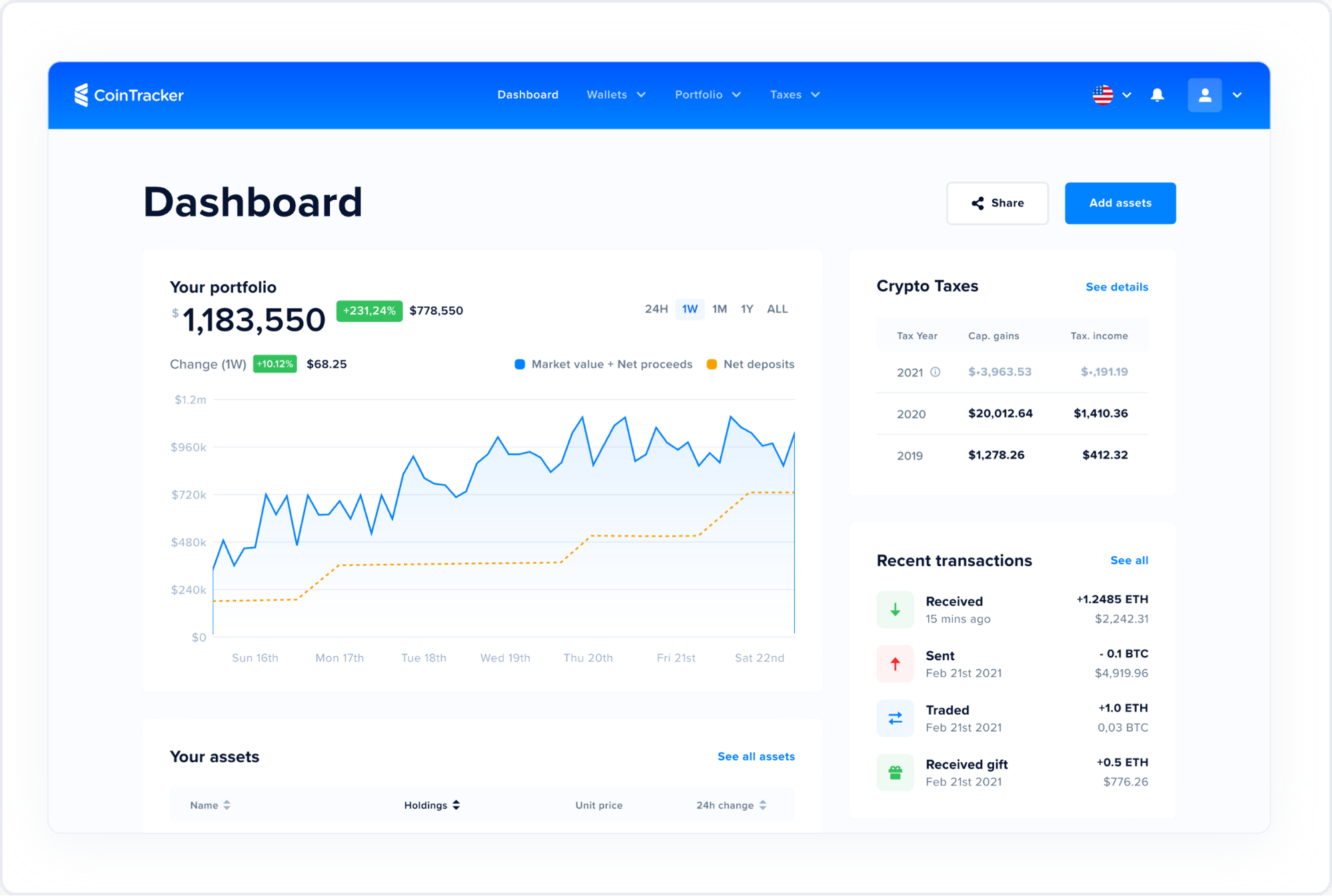

Cryptocurrency Taxes In Canada Cointracker

11 Best Crypto Tax Calculators To Check Out

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

How Do I Manually Report My Cryptocurrency Gains Or Losses Help Centre

Koinly Review What You Need To Know About This Crypto Tax Calculator

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

10 Best Crypto Tax Software Options Compared 2021 Relite Blog

Best Crypto Tax Calculator Canada In 2022 Skrumble

Crypto Com Tax The Best Free Crypto Tax Bitcoin Tax Calculator

These Tools Will Help You Calculate Your Crypto Taxes Taxes Bitcoin News

Best Crypto Tax Software Top Solutions For 2022

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Crypto Taxes In Canada Adjusted Cost Base Explained

Koinly Free Crypto Tax Software

Guide To Bitcoin Crypto Taxes In Canada Updated 2022

11 Best Crypto Tax Calculators To Check Out

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare